Forward-thinking Investments

.jpg)

Paul’s investments were often driven by an intuitive understanding of the future, something he first embraced at a young age during a visit to the 1962 Seattle World’s Fair. That optimism for what was possible would show up throughout his lifetime and become reflected in his numerous business ventures. His vision of a digital future began in his earliest days at Microsoft. For example, in a 1977 interview with Microcomputer Interface, he made a prophetic statement that accurately describes our world today: “If you take [the computer to] its limit, perhaps you could have groceries delivered, take care of all your bills, and, if you’re a programmer, you could do your work at home.”

“I was drawn by nature to people who, like me, were eager to see what might come next and wanted to try to make it happen. From my youth, I’d never stopped thinking in the future tense.”

— Paul G. Allen

In the 1990s, Paul believed humanity was on the cusp of becoming a “wired world" and some of his earliest investments after leaving Microsoft fueled the bleeding edge of this digital transformation. For Paul, this wired world was the future. It held the promise of high-speed connectivity and would fundamentally change communication, information, entertainment, and commerce. He could envision these rapid transformations coming. “I invested in more than a hundred internet, media, and communications companies, expecting some to pan out and some not,” he said. In 1992 he founded Asymetrix, his first post-Microsoft company, a software firm focused on the web presentation and e-learning markets. He also created Interval Research, which focused on the development of next-generation technology and applications, launching seven start-ups and registering 300 patents. (The company’s creations included precursors to the QR code and iPad.)

Paul then went on to create his investment firm, Vulcan Capital, where early investments included AOL, Ticketmaster, DreamWorks, and Starwave (parts of which would evolve into ESPN.com) — all perfect examples of how he could see the future companies’ successes would often hinge on interactive and internet-driven content.

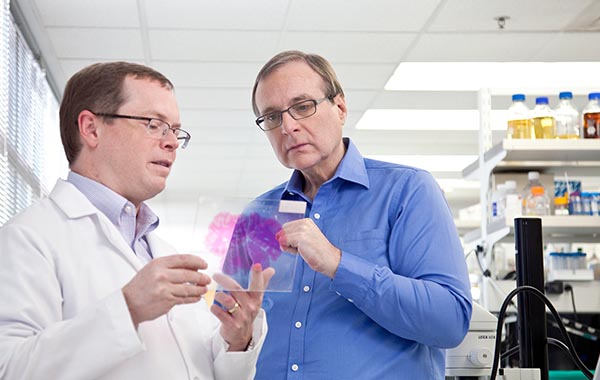

In more recent years, Paul's investments included several paradigm-shifting industries and companies. Notable examples include: Redfin, at the rise of mobile-first applications; Juno Therapeutics, creators of a pipeline of cancer immunotherapy drugs; BlackSky, a next-generation space company dedicated to democratizing space accessibility; and Transparent Financial Systems, a firm at the forefront of the digital B2B payments revolution.

Paul then went on to create his investment firm, Vulcan Capital, where early investments included AOL, Ticketmaster, DreamWorks, and Starwave (parts of which would evolve into ESPN.com) — all perfect examples of how he could see the future companies’ successes would often hinge on interactive and internet-driven content.

In more recent years, Paul's investments included several paradigm-shifting industries and companies. Notable examples include: Redfin, at the rise of mobile-first applications; Juno Therapeutics, creators of a pipeline of cancer immunotherapy drugs; BlackSky, a next-generation space company dedicated to democratizing space accessibility; and Transparent Financial Systems, a firm at the forefront of the digital B2B payments revolution.

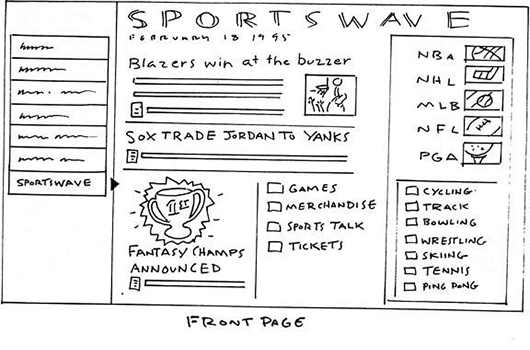

While best known for Microsoft, Paul was constantly searching for the next horizon in technology. This was Paul's sketch when forming the company Starwave, which was a precursor to ESPN.com.

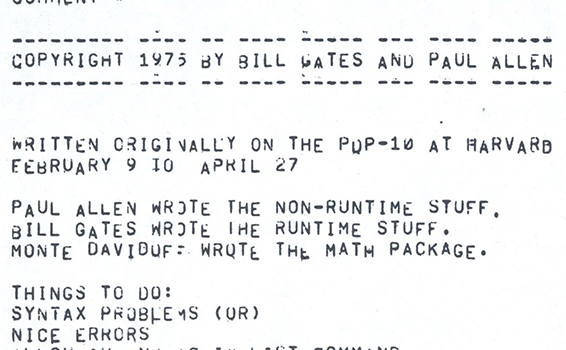

The title page from Microsoft's first product BASIC, the springboard for Paul's interest in forward-thinking technology.

While best known for Microsoft, Paul was constantly searching for the next horizon in technology. This was Paul's sketch when forming the company Starwave, which was a precursor to ESPN.com.

The title page from Microsoft's first product BASIC, the springboard for Paul's interest in forward-thinking technology.